Unlocking Financial Fortunes: Briansclub Presents Exclusive Insights

The necessity of financial literacy in today’s world

In the age of avocado toast and internet shopping could take our bank accounts down faster than we could claim “credit card debt” financial literacy has never been more essential. There is no longer a time where parents could keep a little cash under the bed and declare it over. With complicated financial systems and changing economic conditions, it’s essential to be equipped with the necessary knowledge and expertise to make educated financial decisions.

The Effects of Financial Literacy on the Personal Finances of Individuals and Wealth

Financial literacy doesn’t only mean knowing how to balance a checkbook (does anyone actually use them these days?). It’s about having the confidence to manage our finances, and create the long-term wealth. If we are able to comprehend concepts such as savings, budgeting, investing in addition to managing the debt we have, we’re capable of making choices in our finances that bring us closer to a better future. It’s not just an abstract term It’s the secret in unlocking the financial potential.

2. Understanding the current Economic Landscape

Examining the Global Economic Outlook

Ah world economic forecast – a subject that is as thrilling than watching paint drying. But let us take a step back, since knowing the current economic climate is vital to making educated financial decision. From trade wars and technological advancements There are many things that can affect the economy at a global and local scale. Therefore, pour yourself an cup of coffee and let’s explore our world of business developments!

The impact of economic trends on Businesses and Individuals

You may be surprised to learn that economic developments can have an impact on our lives. From the labor marketplace to the interest rate, knowing how these trends impact business and individuals can help us overcome financial hurdles and take advantage of opportunities. When it comes to deciding whether to purchase that dream house or setting up a new venture knowing about the economic outlook can help us in reaching the financial targets we have set.

3. Exclusive Insiders from Briansclub: The Key Strategies to Financial Prosperity

Information and Expertise from Briansclub

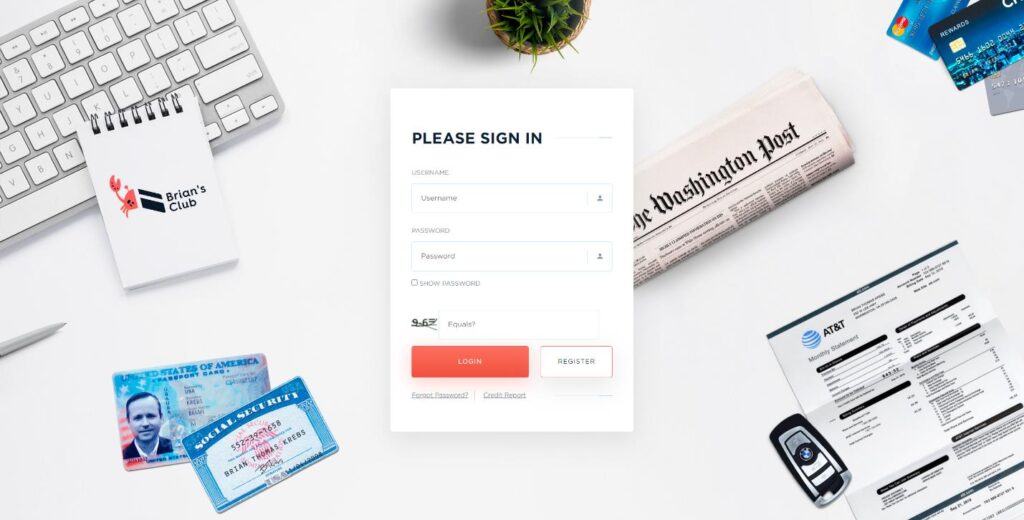

We’ve now covered the significance of financial literacy and the economy now is the time to take advantage of Briansclub’s wisdom. These financial experts have been around for a while (and the market) and have accumulated an impressive amount of information and know-how. From investment strategies to saving tips, methods, Briansclub shares exclusive insights to help us attain financial success.

Proven Strategies to Ensure Financial Performance

It’s true that there’s no universal formula for financial success. Yet, Briansclub has identified some tested strategies that can put our financial future on the right track. From establishing a sound budget to diversifying investments There are a number of practical actions we can follow to establish the foundation of the future of our finances. So, get the pen and paper as these strategies could change our financial situation.

4. Navigating Investments: Unveiling Lucrative Opportunities

The Fundamentals of Investment The Basics of Investment: Bonds, Stocks, and Real Estate

It can be as daunting as solving the Rubik’s Cube with your eyes closed. But don’t be afraid! Let us break down the fundamentals of investing into small chunks. From bonds to stocks, as well as real estate knowing the basics of these investment vehicles will aid us in making informed choices on where to invest the money we’ve earned.

Finding Investment Opportunities with the Potential to be Promising

After having gone over the fundamentals, we can reveal the secret to investing: identifying opportunities. It doesn’t matter if it’s a tech company with a high growth startup or a property undervalued There are hidden treasures that are waiting for you to discover. With just a amount of investigation and a bit of luck we can unlock the potential for a lucrative return. Put your detective hat on and begin searching for the investment unicorns!

5. Financial Management Strategies for budgeting and saving

The creation of a budget for your personal needs is an essential step towards Financial Freedom

Budgeting is a word that evokes terror and fear into the minds of a large number of. However, don’t be afraid! Making a budget for yourself isn’t as difficult as it may sound and is the first step to becoming financially free. When creating a budget begin by identifying all the sources of income you earn and then add the expenses you incur each month which include bills, food and the sneaky costs that seem to appear out of out of the blue. When you’ve got an exact image of your income and expenses, you’re ready to make tough choices. Find areas where you can reduce or cut out unnecessary expenditures. Maybe your daily coffee from a takeaway will soon become a regular treat or you may discover ways to cut down on costs for utilities. Keep in mind that every penny saved can be a step towards financial freedom.

Achieving Savings: Strategies and Tools to Ensure Effective Saving

Once you’ve crafted an budget, it’s now time to get started on the art of saving. It can be a challenge to save money especially in a society where temptations are everywhere all around such as online shopping! To become a master of saving Begin by establishing clear goals for savings. It doesn’t matter if it’s an unforgettable trip, a downpayment for a home or even an emergency fund, setting specific goals will keep you focused. Automate your savings. Automate transfer of your check account into a savings account that’s specifically designed for you. So, you don’t need to think about it as the money will be taken away before you have an opportunity to spend it. Keep track of your performance. Make use of spreadsheets or applications to track your savings targets and mark important milestones as you go. Be aware that the process of saving money is an individual finance version of playing a video game. Each stage unlocked will bring your financial goals closer!

6. The power of compound interest to create long-term wealth

Understanding the concept of Compound Interest

Compound interest, the magic force that could turn just a few dollars into a fortune over the course of time. Knowing this concept is essential for anyone seeking to build the long-term wealth. In simple words, compound interest refers to interest that is earned from both the initial investment and the interest accrued from earlier times. It’s akin to a snowball of money that is rolling down a hill, increasing in size and speed with each step. Let’s suppose you put up $1,000 and an annual rate of 5 percent. The first year you’ll earn $50 interest, which brings the amount to 1,050. In the following year the 5% interest is not just added to the initial $1,000 as well as the $50 you earned during that first year. This effect of compounding continues and, over time, your funds will multiply exponentially.

Harnessing Compound Interest to help long-term wealth accumulation

Once you’ve grasped the potential of compound interest you’re ready to use it to your advantage. It’s important to begin early and remain constant. The longer your investment will expand, the greater the effect from compounding interest. You should consider making investments in retirement savings accounts, such as one called a 401(k) as well as an individual retirement account (IRA). These accounts provide tax advantages and let your investments expand over time. Furthermore, diversify your investments. Don’t put all of your finances in one basket. Divide your investments over various categories of assets, including bonds, stocks and real estate to limit the risk and increase your potential return. Keep in mind that building wealth over the long term is an endurance race not the equivalent of a sprint. Be patient, be constant then let the compounding effect do its magic.

7. The Unlocking of your Secrets of Credit: Managing the Debt Effectively

The role of credit in personal finance

Credit is the double-edged sword. If handled properly it can open doors to opportunities such as buying homes or establishing an enterprise. If it is not handled properly it could become an expense for the financial system. Understanding the importance of credit in your personal finances is vital. Credit is the basis for your ability to obtain loans, and also affects the rate of interest on loan, premium for insurance and even your job prospects in certain cases. A good credit score is vital. Pay on time for all credit accounts, make sure your credit utilization stays lower, and steer clear of any the burden of debt.

Strategies for managing and reducing the amount of debt

If you’re already knee-deep in debt, fear not! There are ways to handle it and cut it down effectively. Begin by drafting an effective plan for repayment of debt. Write down the total amount of debt you have, the interest rates, and the minimum monthly payment. Determine the amount you’re able to afford into debt repayment every month. Think about using the snowball method or avalanche method of making payments on debts starting from the lowest to the highest or first tackling debts with high interest. Another option can be used to consolidate debt, and this combines multiple debts into one credit or loan that has an interest rate that is lower. This will make it easier to manage your payments on a monthly basis and reduce the cost of interest. Keep in mind that managing debt is about slow advancement. Keep your finances in check, eliminate unnecessary costs, and concentrate on reducing the debt mountain in pieces.

8. The Building of the foundation for a Strong Financial Foundation: Education and Resources

The significance of Financial Education

In a world that is brimming with financial jargon that is confusing and constantly evolving markets the financial education course is the best weapon you have. It helps you make educated decisions about your finances, steer clear of frauds and miss out on opportunities. Learn about topics in personal finance, including planning your budget, saving, investing as well as retirement plans. There are many online courses and books, as well as YouTube channels, and podcasts to aid you in becoming an expert on financial matters.

Highly Recommended Sources for Building Financial Knowledge

Are you looking for excellent resources to increase your knowledge of finance? Here are some suggestions to start Sites Look up reputable financial sites like Investopedia, The Balance, and NerdWallet for an abundance of information. Book: “The Total Money Makeover” by Dave Ramsey, “Rich Dad Poor Dad” by Robert Kiyosaki, and “The Intelligent Investor” by Benjamin Graham are excellent reads for anyone wanting to boost your financial skills. Podcasts: Tune in to podcasts such as “The Dave Ramsey Show,” “ChooseFI,” and “The Side Hustle School” to gain valuable insight and motivation. YouTube Channels: Check out channels such as The Financial Diet, Graham Stephan as well as Andrei Jikh for entertaining and informative personal finance-related content. Be aware that building a solid financial foundation is a continuous process. Be curious, continue to learn and, when you’re done you’ll be in control of your financial fortunes to unlock financial wealth, it is a matter of understanding of strategic thinking, tactical thinking, and discipline. By acknowledging an understanding of the value of being financially educated and applying the specific advice of Briansclub.cm in this article, people are able to take charge of your financial destiny. It doesn’t matter if it’s making prudent financial decisions and managing debt effectively or laying a strong financially solid foundation opportunities of financial success are within reach. Through dedication, education and a positive outlook everyone can make a path to a prosperous and safe financial future.